Kuala Lumpur Kepong Berhad (“KLK”) today started as a plantation company in 1906 and is listed on the Main Market of Bursa Malaysia Securities Berhad. As of the end of September 2023, the Company has a market capitalisation of approximately RM22.520 billion.

The Early Days

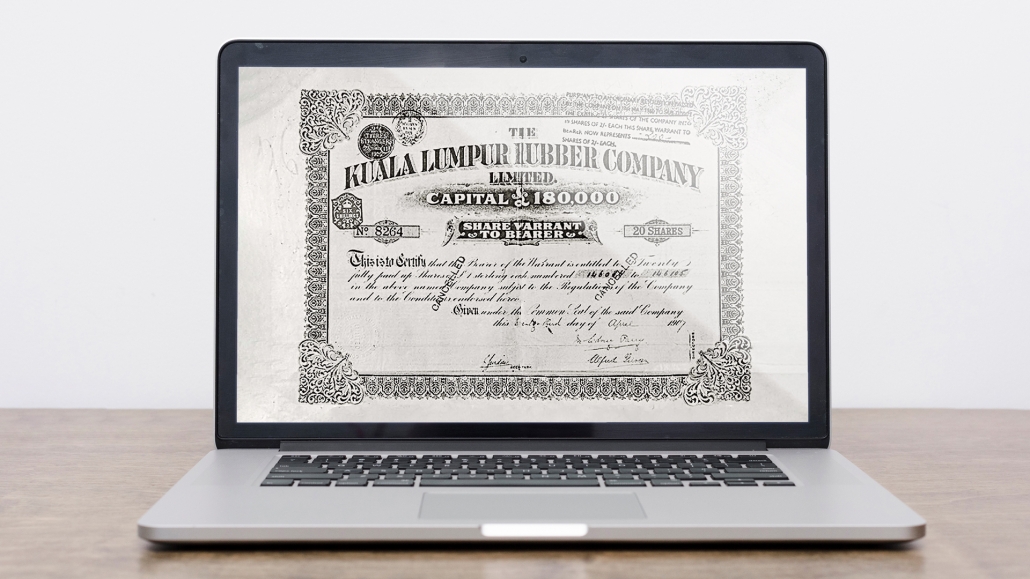

The Kuala Lumpur Rubber Co. Ltd (KLR) was incorporated on 19 May 1906 to capitalise on the booming rubber industry. Its offices were situated at 9 Arundel Street in London. With a paid-up capital of £180,000, KLR acquired five estates around the then Kuala Lumpur area totalling 640 hectares.

Around 1906, the price of Brazilian rubber rose to a record-breaking £710 per tonne and the London stock market was buzzing with excitement. In this one year, twenty-seven rubber plantation companies were established. However, the rubber slump hit its lowest point during the Great Depression which began in 1929 and remains the most lengthy and serious global economic recession on record.

KLR also entered the tin mining business when tin ore was found on some of its properties. It leased these lands to mining companies in 1923 and tin dredging was carried out for several decades, earning the company income from royalties that were levied on the extracted tin.

KLR began expanding its rubber operations again in 1933 but their period of growth came to an abrupt end when the Japanese invasion of Malaya in December 1941. When allied forces liberated Malaya in August 1946, it paved the way for the British Military Administration to re-establish control. KLR spent several years investing in rehabilitative works, but efforts were complicated by attacks from communist insurgents. Rubber plantations were a prime target as the communists sought to undermine colonial control of Malaya’s economic assets and strike fear into the hearts of the population.

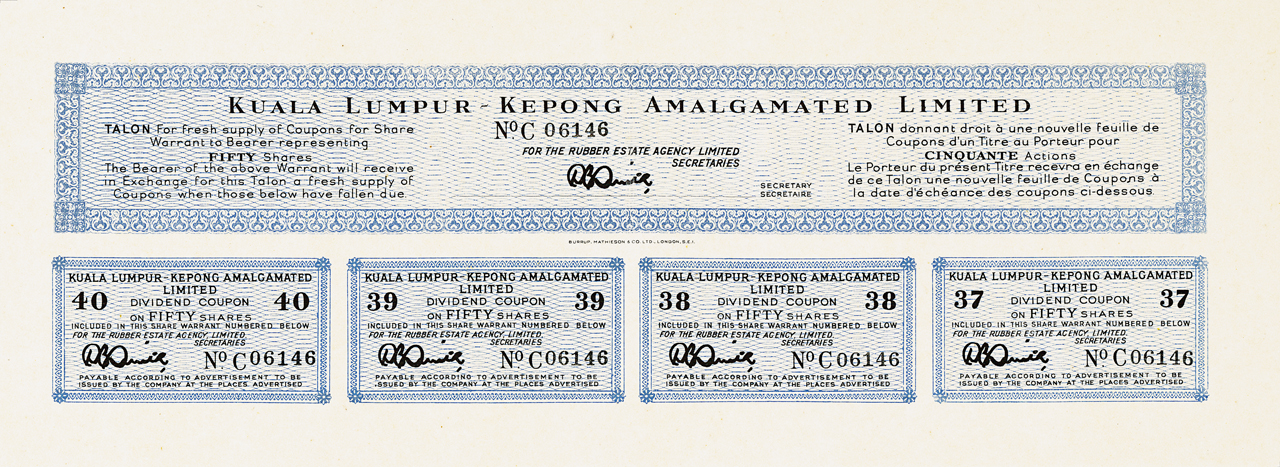

When Malaya declared independence in 1957, KLK began expanding its holdings between 1959 and 1961. These transformative moves saw KLR changing its name to Kuala Lumpur-Kepong Amalgamated Limited (KLKA) in 1961.

Troubling Times

On 13 May 1969, when racial riots erupted in Kuala Lumpur, a state of emergency was declared and Parliament suspended. Investor confidence in Malaysia plummeted in the aftermath of the riots, sending prices of listed companies tumbling across the stock exchange. KLKA was not spared, despite having persevered with the country through a war, a violent insurgency, the end of colonial rule and the independence of Malaya.

The grossly under-valued KLKA shares did not escape the attention of Lee Loy Seng (later honoured as Tan Sri Dato’ Sri Lee Loy Seng), the son of a tin-miner from Ipoh who earlier on had already shown an interest in rubber plantations and had the confidence and foresight to accumulate a block of KLKA shares.

Bringing KLKA Home

17 April 1970 marked the beginning of a turnaround for KLKA when Lee Loy Seng was appointed to the Board. He set out to make estate operations more efficient and productive and by 31 December 1971, the then 65-year old London Board held its last meeting followed by an Extraordinary General Meeting that passed a special resolution approving the transfer of KLKA’s residence to Malaysia.

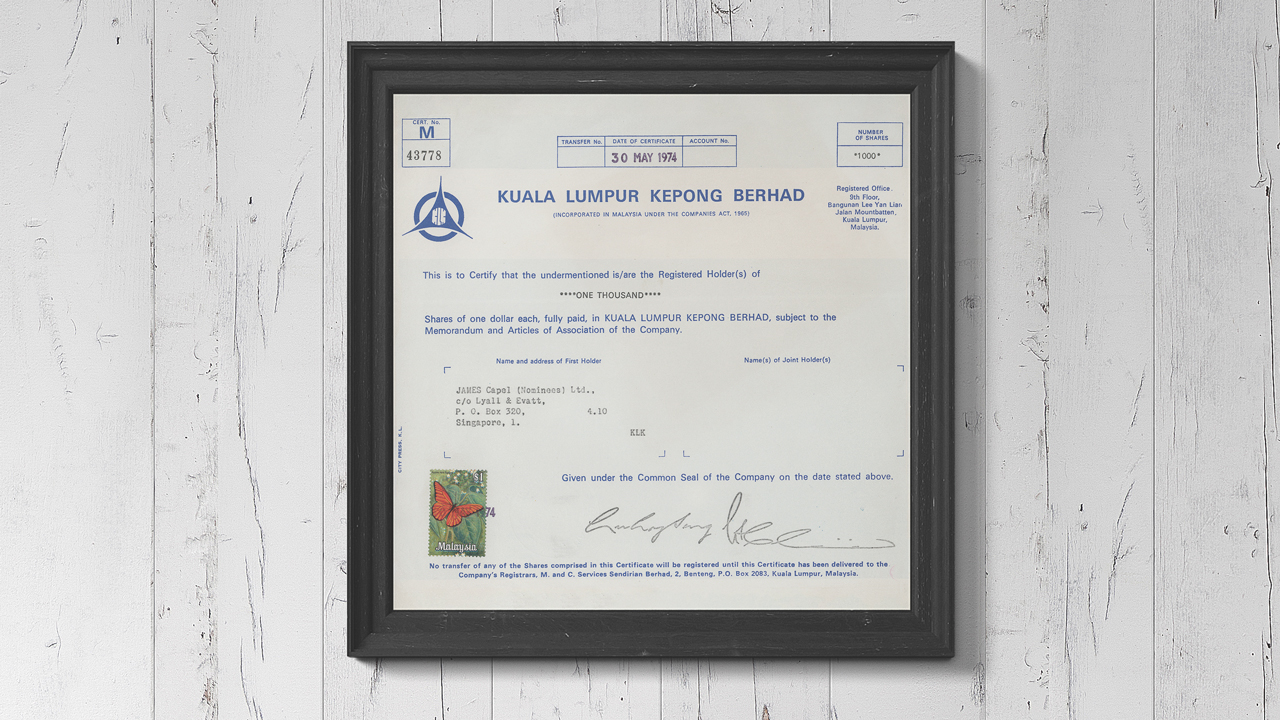

The final step in bringing KLKA home took place in 1973 where under a Scheme of Reconstruction, Kuala Lumpur Kepong Berhad (KLK) was set up in Malaysia and Lee Loy Seng was appointed the Founder Chairman. KLK was incorporated on 6 July 1973 to take over all assets and liabilities of KLKA via a share exchange of four KLK shares of RM1 each for every KLKA share of 10 pence each.

KLK shares were subsequently listed on the stock exchanges of London, Singapore and Kuala Lumpur. The listing on the stock exchange of Singapore ceased on 1 January 1990 in compliance with national policy. Due to the negligible trading volume of KLK shares on the London Stock Exchange, KLK withdrew its listing from the London Stock Exchange on 1 May 2005.

Expansion into Sabah and Indonesia

In late 1983, KLK ventured into Sabah, acquiring 12,545 hectares of mixed oil palm and cocoa land in Tawau. From then on, other acquisitions in the vicinity and also around Lahad Datu increased the Group’s hectarage to approximately 40,000 hectares.

Almost a decade later, KLK made a landmark decision to invest in Indonesia in 1994 when the Group bought plantation land in Belitung Island and later on ventured into Riau, North Sumatra and Kalimantan. As a result thereof, the Group’s Indonesian plantation was approximately the same size as that of its Malaysian plantation. KLK’s investment in Indonesia was set to expand further with the setting up of its first oleochemical plant in Dumai.

Industry Diversification

Even as plantation operations picked up the pace, KLK’s management saw it fit to begin diversifying its business to cushion the effects of fluctuating commodity prices. The 1990s were marked with new ventures, mainly in manufacturing and retail. By the 2000s, KLK was grinding cocoa, producing latex gloves, manufacturing wood flooring and soap and retailing skin and bath products, home fragrances and fine foods.

Property development too became another key business when the Group launched Desa Coalfields, a residential and commercial property project in Sungai Buloh, Malaysia.

A Legacy Continued

On 22 November 1993, Tan Sri Dato’ Seri Lee Loy Seng, Founder Chairman of KLK passed away after a short illness. Lee Oi Hian (later honoured as Tan Sri Dato’ Seri Lee Oi Hian) was appointed to succeed him, and he continued to build on the diversification initiatives launched earlier, particularly in the oleochemical business while at the same time exploring expansion opportunities in plantation development overseas.

Today, KLK is amongst the top-performing plantation companies in the industry and in Malaysia, with plantations located in Malaysia, Indonesia and Liberia. The Group’s manufacturing operations have also expanded globally through joint ventures and acquisitions. Its property division also jointly developed the prestigious Sierramas, completed the development of the residential and commercial property project of Desa Coalfields and is currently focused on Bandar Seri Coalfields, a 1,001-acre township located in Sungai Buloh, Malaysia.

The sound stewardship and solid foundation laid by the late Tan Sri Dato’ Seri Lee Loy Seng has been nurtured, strengthen and propelled to the global stage by the next generation of the Lee family, notably our present Chief Executive Officer, Tan Sri Lee Oi Hian. KLK is acknowledged by the corporate world as a blue-chip company with a reputation for sturdy management and strong earnings with interest in various industries the world over.

Milestones

1901 - 1920

1906

Kuala Lumpur Rubber Co. Ltd.(KLR) was incorporated in England with the Hon. Everard Feilding as Chairman. KLR held five estates in Malaya (now known as Malaysia) totalling 1,582 acres (640 ha).

1907

The shares of KLR were listed on the London Stock Exchange.

1921 - 1940

KLR entered the tin mining business when tin ore was found on some of its properties. The lands were leased to mining companies and tin dredging was carried out in Kundang, Keng and Wardieburn estates for several decades, earning KLR a steady source of income.

1941 - 1969

1957

The KLR Cadet Training School was established in Effingham Estate, Kuala Lumpur to train future Malayan plantation managers and staff.

1961

KLR changed its name to Kuala Lumpur-Kepong Amalgamated Ltd. (KLKA).

KLR acquired Eastern Sumatra Rubber Estates Ltd., which owned plantations in Sumatra, Indonesia resulting in the company expanding its total landholdings to approximately 73,000 acres (29,844 hectares).

1962

KLKA began diversifying its rubber plantations to oil palm. The historic move began with the planting of 1,000 acres in Fraser Estate.

1967

Subsequent plantings of close to 2,000 acres a year led to the commissioning of the Group’s first palm oil mill (Fraser Palm Oil Mill) in Fraser Estate.

1970 - 1980

Two Malaysian directors, Mr. Lee Loy Seng and Mr. Yeoh Chin Hin, were appointed to KLKA’s Board.

A special resolution was passed in KLKA’s Extraordinary General Meeting approving the transfer of KLKA’s residence to Malaysia..

Kuala Lumpur Kepong Berhad (KLK) was incorporated in Malaysia. Under a Scheme of Reconstruction in Malaysia, KLKA went into voluntary liquidation with KLK taking over the assets and liabilities of KLKA.

The Group acquired 28,000 acres (11,331 ha) of jungle land in north-central Johor. The area was cleared and planted with oil palm at an approximate cost of RM53 million which was partially financed by an issue of 23 million debenture stocks in 1975. The debenture stocks were fully redeemed in 1981.

1974

KLK’s shares are listed on the stock exchanges of Kuala Lumpur, Singapore and London.

Acquisition of all the minority shareholdings in Kepong Plantations Berhad.

Corporate Head Office moved from Kuala Lumpur to Ladang Pinji, Perak Darul Ridzuan.

1981 - 2000

The present day Training Centre in Ipoh was established to provide training for all levels of plantation executives and staff.

Taiko Plantations Sdn. Berhad, a plantation management company, became a wholly-owned subsidiary of KLK.

The Group’s first palm oil refinery, KL-Kepong Edible Oils was commissioned.

The year marked the Group’s entry into Sabah with the acquisition of 12,551 ha of plantation land together with a mill in Tawau.

The Group’s Corporate Head Office moved to Wisma Taiko, located in the heart of Ipoh City.

Acquisition of 12,146 ha of plantation land in Negeri Sembilan Darul Khusus and Selangor Darul Ehsan, in exchange for the Company’s holding in Highlands & Lowlands Berhad.

A 50:50 joint venture company, Applied Agricultural Research Sdn. Bhd. (now known as Applied Agricultural Resources Sdn. Bhd.) was formed between KLK and Boustead Holdings Berhad to carry out applied research and development which support the plantation activities of the Group.

The second palm oil refinery was commissioned in KDC Complex in Tawau, Sabah. The refinery was subsequently decommissioned in 2007.

Delisting of the Company’s shares from the Stock Exchange of Singapore Limited in line with the country’s national policy.

KL-Kepong Cocoa Products Sdn Bhd (KLKCP) was incorporated to spearhead downstream manufacture of cocoa products with joint-venture partners.

KLK ventured into property development through KLK Land.

Further acquisition of 2,955 ha of plantation land in Tawau, Sabah from Kung Hing Plantations Sdn. Bhd.

KLK expanded beyond plantations into resource-based downstream manufacturing to cushion the effects of fluctuating commodity prices of oil palm and rubber. The year marks KLK’s entry into oleochemicals through Palm-Oleo Sdn. Bhd.

Acquisition of Susuki Sdn. Bhd. together with 2,915 ha of plantation land in Sandakan, Sabah.

Issuance of 51.5 million KLK shares to Batu Kawan Berhad (BKB) for the acquisition of 11,215 ha of plantation land and The Kuala Pertang Syndicate Ltd. and The Shanghai Kelantan Rubber Estates (1925) Ltd. from BKB.

The Group’s commissioned its first cocoa grinding plant (KLKCP) in Port Klang.

Acquisition of 70% of the equity of Sabah Holdings Corporation Sdn. Bhd. and Sabah Cocoa Sdn. Bhd. together with 5,587 ha of plantation land in Lahad Datu, Sabah.

Acquisition of Golden Sphere Sdn. Bhd. and Richinstock Sawmill Sdn. Bhd., together with 7,814 ha of plantation land in Lahad Datu, Sabah.

Tanjong Malim Concentrate Rubber Factory was the first centre in the Group to be awarded the MS ISO 9002 by SIRIM.

The Group’s re-entry into Indonesia with the acquisition of 14,170 ha of contiguous land in Belitung Island.

Acquisition of 60% of the equity of Bornion Estate Sdn. Bhd. together with 3,235 ha of plantation land in Sandakan, Sabah.

Acquisition of the Standard Soap Company Ltd., in the United Kingdom which is involved in contract soap manufacturing.

Acquisition of P.T. Adei Plantation & Industry which owns 27,771 ha of plantation land in Sumatra, Indonesia.

Entry into retailing through the acquisition of Crabtree & Evelyn, a leading international manufacturer and retailer of personal care products, toiletries, home fragrance products and fine foods.

Acquisition of the entire issued and paid-up capital of Masif Latex Products Sdn. Bhd. which manufactures household gloves (now operating as KL-Kepong Rubber Products Sdn. Bhd).

Entry into parquet manufacturing through the acquisition of the entire issued and paid-up capital of B.K.B. Hevea Products Sdn Bhd (B.K.B. Hevea) from BKB.

The Group’s first palm oil mill in Indonesia was commissioned in Belitung Island, Indonesia with a capacity of 80 tn/hr (SWP Palm Oil Mill).

The Group’s first rubber factory in Indonesia was commissioned in Duri, Sumatra (Mandau Rubber Factory).

2001 - 2010

Tanjong Malim Concentrate Rubber Factory was the first centre in the Group to be awarded the “Environmental Management Systems Approval Certificate – MS ISO 14001″ for safeguarding the environment.

Launch of the Group’s 93 ha property development project known as ‘Desa Coalfields’ off Sungai Buloh in Selangor Darul Ehsan.

Acquisition of 48% equity in P.T. Sekarbumi Alamlestari which owns 6,203 ha of oil palm plantation land together with a 30 tn/hr mill in Sumatera, Indonesia.

KLK launches its website at www.klk.com.my

The official launch of the KLK Newsletter for the Group’s employees by the Chairman and Chief Executive Officer of the KLK Group, Dato’ Lee Oi Hian.

The official launch of the KLK Newsletter for the Group’s employees by the Chairman and Chief Executive Officer of the KLK Group, Dato’ Lee Oi Hian.Delisting of the Company’s shares from the London Stock Exchange.

Acquisition of 51% of Davos Life Science Pte. Ltd., Singapore; a start-up company manufacturing nutraceutical, cosmeceutical and pharmaceutical products.

Acquisition of 51% of Stolthaven (Westport) Sdn. Bhd., which operates an independent common user liquid storage facility.

100 Year Anniversary of Kuala Lumpur Kepong Berhad.

Official opening of Taiko Palm-Oleo (Zhangjiagang) Co. Ltd.’s oleochemical plant in China by YB Datuk Peter Chin Fah Kui, Minister of Plantation Industries and Commodities of Malaysia.

Acquisition of Tri-Force Element Inc and Double Jump Limited. The two companies together hold a 95% interest in P.T. Jabontara Eka Karsa which owns approximately 14,086 ha in Indonesia.

Official opening of Kekayaan Palm Oil Mill with a 120 tn/hr capacity.

Acquisitions of P.T. Menteng Jaya Sawit Perdana and P.T. Karya Makmur Abadi each of which own approximately 7,400 ha and 15,000 ha of land respectively in Kalimantan, Indonesia intended for oil palm cultivation.

Bonus Issue of 354,988,564 ordinary shares of RM1.00 each in KLK credited as fully paid-up on the basis of one new KLK share for every two existing KLK shares.

Acquisition of Golden Complex Sdn. Bhd. which has a 92% equity stake in P.T. Malindomas Perkebunan which holds approximately 8,266 ha of plantation land in Berau, East Kalimantan, Indonesia.

Acquisition of Uniqema (Malaysia) Sdn. Bhd. (now known as Palm-Oleo (Klang) Sdn. Bhd.) which is involved in the manufacture of glycerine, fatty acids, esters and soap noodles.

Mandau Kernel Crushing Plant in Pekanbaru, Indonesia with a processing capacity of 800 tn/day was commissioned.

Acquisition of Shanghai Jinshan Jinwei Chemical Company Limited which specialises in the manufacturing of fatty amines, cationic surfactants, and auxiliary materials for cosmetics and detergent industries.

Acquisition of Dr. W. Kolb Holding AG, a large independent alkoxylator and a large manufacturer and distributor of non-ionic surfactants and esters.

Official opening of Applied Agricultural Resources’ Tissue Culture Laboratory in Sungai Buluh, Selangor by YB Datuk Peter Chin Fah Kui, Minister of Plantation Industries and Commodities of Malaysia. The laboratory is able to produce more than 1 million ramets per year.

Completion of the acquisition of the entire equity interest in Ladang Perbadanan-Fima Berhad (“LPF”), by Ablington Holdings Sdn. Bhd. LPF has a land bank of more than 8,171 ha.

KLK, via its wholly-owned subsidiary, KL-Kepong Plantation Holdings Sdn. Bhd. entered into a Joint Venture Agreement with P.T. Perkebunan Nusantara II (Persero) (“PTPN II”) to form a joint venture company, P.T. Langkat Nusantara Kepong (“PT LNK”).

PT LNK leases and manages approximately 20,700 ha of land planted with oil palm and rubber, two palm oil mills and three rubber factories, all located in Sumatera, Indonesia and belonging to PTPN II.

Acquisition of 17% equity interest in P.T. Sekarbumi Alamlestari (“PT SA”) by KL-Kepong Plantation Holdings Sdn. Bhd., which has an existing 48% interest thus making P.T. SA a subsidiary of KLK.

P.T. SA owns an area of approximately 6,200 ha located in Riau Province, Indonesia; planted with oil palm and with a palm oil mill.

Acquisition by KL-Kepong Oleomas Sdn Bhd of the entire equity interest of Zoop Sdn. Bhd. (“Zoop”), together with a piece of leasehold land of approximately 137,476 square feet in Shah Alam, Selangor with a biodiesel plant, thus making Zoop (now known as KLK Bioenergy Sdn. Bhd.) a subsidiary of KLK.

A merger of KLK’s wholly-owned subsidiaries in Germany namely, KLK Emmerich, Rheinsee 312 and Uniqema. As a result of the merger, the separate existence of Rheinsee 312 and Uniqema had ceased and merged with and into the surviving corporation, KLK Emmerich, on 29 September 2010.

Acquisition of Uniqema GmbH & Co. KG (now known as Uniqema OHG) (“Uniqema”) by KLK, together with its wholly-owned subsidiaries, KLK Emmerich and Rheinsee 312, of the entire interest and business assets used in the business of Uniqema.span>

Uniqema’s business is in the manufacture of basic oleochemicals (fatty acids and glycerine. The products manufactured by Uniqema are used by a wide variety of industries as intermediates for the manufacture of food additives, detergents, fabric softeners, cosmetics, lubricants, plastic additives, etc.

Acquisition of 95% equity stake in P.T. Alam Karya Sejahtera (“PT AKS”) by P.T. Sekarbumi Alamlestari making PT AKS a subsidiary of KLK.

P.T. AKS holds certificates of Izin Lokasi for approximately 5,900 ha located in Kecamatan Membalong and Kecamatan Dendang in Belitung, the Republic of Indonesia for purpose of oil palm development.

2011 - Present Day

Disposal of global Crabtree & Evelyn business via the sale of 100% of the equity interest in CE Holdings Limited to Khuan Choo International Limited.

Acquisition of 95% equity stake in P.T. Anugrah Surya Mandiri (PT ASM) which holds a Certificate of Izin Lokasi for land measuring approximately 3,700 ha located in Kampung Batu Putih, Kecamatan Batu Putih – Kabupaten Berau, Indonesia for purpose of oil palm development.

Acquisition of 63.2% equity stake in Equatorial Palm Oil Plc (EPO) via a Mandatory General Offer. EPO is listed on the Alternative Investment Market of the London Stock Exchange. EPO is engaged in the business of oil palm plantations in Liberia via its 50% equity interest in Liberian Palm Developments Limited (KLK owns the remaining 50% interest).

Commissioned the Group’s first refinery with a capacity of 1,000 mt/day in Belitung Island.

Formed a joint venture with P.T. Astra Agro Lestari Tbk (AAL) in connection with a Singapore incorporated company named Astra-KLK Pte. Ltd. (ASK) to market refined palm oil products and provide logistics services related to the said products. KLK and AAL have a 51% and 49% equity interest in ASK respectively.

Launched the KLK Sustainability Policy outlining the Group’s commitment towards sustainable practices.

Acquired 100% of Tensachem SA, a Belgian company that owns a specialty chemical (surfactants) plant and business in Liege, Belgium.

Acquired 100% of Tensachem SA, a Belgian company that owns a specialty chemical (surfactants) plant and business in Liege, Belgium.

Disposal of 55% equity interest in Voray Holdings Limited in Hong Kong (which has investments in a cooking oil packaging business and bulking installation in the People’s Republic of China).

All of KLK’s plantations in Malaysia are certified sustainable by the Roundtable of Sustainable Palm Oil (RSPO).

Acquired oleochemical assets and business in Holthausen, Dusseldorf. Together with the earlier acquisition of oleochemical assets and business in Emmerich, KLK now operates in two sites in Germany.

Formed a 50/50 joint venture with P.T. Astra Agro Lestari Tbk in connection with an existing company named P.T. Kreasijaya Adhikarya which owns and operates a refinery and bulking installation in Riau, Indonesia.

Brought in a new partner, Mitsui % Co., to hold a 20% interest in the oleochemical assets in Zhangjiagang, People’s Republic of China.

Formed two property development joint venture companies via Shareholders’ Agreements with UEM Land Berhad (UEMLB):

(i) Scope Energy Sdn Bhd (SESB) wherein KLK holds 60% equity interest in SESB and the remaining 40% by UEMLB; to develop 500 acres of freehold land located in Mukim Tanjung Kupang in the District of Johor Bahru, Johor Darul Takzim into a mixed residential and commercial development; and

(ii) Aura Muhibah Sdn Bhd (AMSB), wherein KLK holds 40% equity interest in AMSB and the remaining 60% by UEMLB; to develop 2,500 acres of freehold land located in Mukim Senai in the District of Kulaijaya, Johor Darul Takzim into a mixed residential, commercial and industrial development.

Issuance of the first KLK Sustainability Report based on the Global Reporting Initiative (GRI) standards with the aim of sharing the Group’s sustainability efforts with our shareholders.

Issuance of the first KLK Sustainability Report based on the Global Reporting Initiative (GRI) standards with the aim of sharing the Group’s sustainability efforts with our shareholders.

Issuance of the first KLK Corporate Responsibility Report to highlight the Group’s corporate responsibility initiatives in our community, for the environment and for our employees.

Issuance of the first KLK Corporate Responsibility Report to highlight the Group’s corporate responsibility initiatives in our community, for the environment and for our employees.

All KLK’s palm oil mills and the supplying estates in Malaysia are fully certified under the Malaysian Sustainable Palm Oil (MSPO) standards as at end of December 2017.

All KLK’s palm oil mills and the supplying estates in Malaysia are fully certified under the Malaysian Sustainable Palm Oil (MSPO) standards as at end of December 2017. Acquisition of Elementis Specialties Netherlands B.V. in Delden, The Netherlands (renamed as KLK Kolb Specialties B.V.). The company offers broad chemical specialties and custom manufacturing capabilities to clients.

Acquisition of Elementis Specialties Netherlands B.V. in Delden, The Netherlands (renamed as KLK Kolb Specialties B.V.). The company offers broad chemical specialties and custom manufacturing capabilities to clients.Acquired control of IJM Plantations Berhad in September 2021 followed by P.T. Pinang Witmas Sejati in October 2021, in line with the KLK Group’s strategy to grow through brownfield acquisitions as part of our pledge to No Deforestation, Peat and Exploitation (NDPE). Combined, both acquisitions increases the Group’s planted area to 300,000 hectares.